Upside down

Boy, you turn me

Inside out

And round and round

The 1980 hit single “Upside Down” by Diana Ross may have been about a cheating lover, but it can also be a metaphor for the inverted yield curve. This phenomenon may seem too technical for the everyday investor, but its implications are too important to ignore.

What the inverted yield curve can tell investors

An inverted yield curve occurs when an investor can make more interest by investing in bonds with shorter maturities than by investing in longer-dated bonds. This is the opposite of what is usually expected; typically, investors should receive higher rates of interest when they loan their money for a longer period of time. When the yield curve inverts, it can be a predictor of recession.

In recent decades an inverted yield curve has often preceded recessions. Some believe this is because of the challenges it produces for banks, whose net interest margin comes from the difference between long and short dated yields. If this margin is compressed, the theory goes, banks are less likely to lend, particularly to marginal borrowers.

Others believe it has more to do with what investors think is going to happen, or investor expectations. When the yield curve is inverted, bond prices reflect expectations that long-term yields will decline, as they often do in a recession.

When investors worry about the economy, yields in long-term bonds begin to look attractive relative to other opportunities, not to mention their potential for price appreciation.

Does the 2022 curve indicate a coming recession?

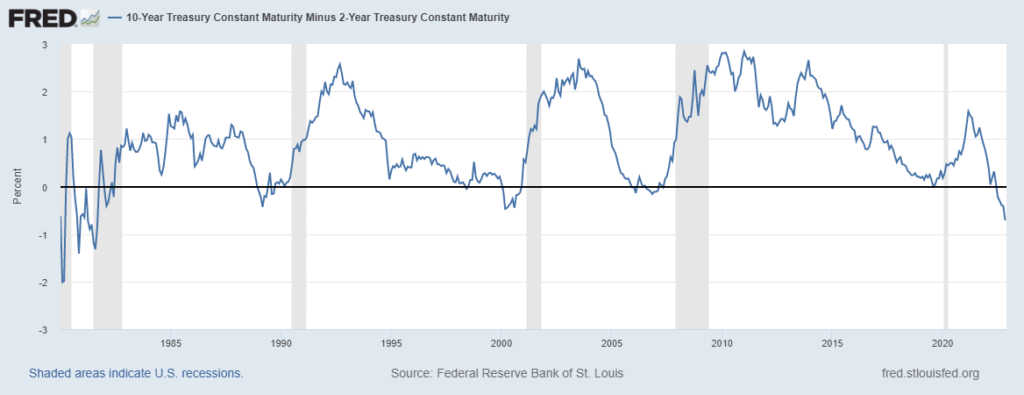

Currently, 86% of the yield curve is inverted, according to Recessionalert.com. The chart below illustrates the two-year treasury bond compared to the 10-year bond. Whenever the line dips below 0, the yield curve inverts and recession (indicated by the shaded vertical bars) tends to follow.

What should you do about it?

Recession can mean lower earnings for corporations, which translates into falling stock prices. We have already had a significant decline in equity markets, and a recession could exacerbate this. Investors should be aware of the implications of an inverted yield curve and make necessary adjustments to their portfolios.

If you would like to have a further conversation regarding your portfolio, please feel free to reach out to us here.

Listen to the yield curve! It is bringing back a 1980s disco hit.