In the year 2525

Everything you think, do and say is in the pill you took today.

-Zager and Evans, 1969

The Austrian government took a big leap towards 2525 when they issued a 100-year bond this year. Investors purchasing this bond will receive a whopping 2.1 percent in interest payments.

Considering its potential volatility, one wonders who would buy such a thing.

In a recent Bloomberg article Marcus Ashworth pointed out that a one basis-point move in yield would move the value of the bond by .43 percent. If rates increased by 2.5 percent the Austrian bond would technically be worthless.

This is a great illustration of a desire for yield without a proper consideration of risk. One wonders if these investors believe our low-rate environment will last for a century.

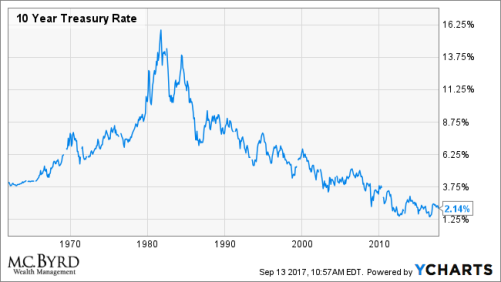

Below is a chart of the U.S. 10-year Treasury rate from 1962 until the present:

As you will note, the rate hardly is stable.

The following is a chart of US interest rates over the last 200+ years (Source):

You will notice that rates move in a secular pattern of +/- 30-year trends. Since bond prices typically move lower as rates rise, a 100-year investment in a period of ultra-low rates seems to lack prudence.

In addition, one has to wonder about the ethical implications of issuing a 100-year bond. Many, if not most of the Austrians who will fulfill this obligation are not presently alive or voting. Of course, the debate on saddling future generations with debt was lost long ago by our descendants.

In our own country the national debt passed the $20 trillion mark just last week. Every man, woman and child owes $61,000 of this debt, saddling our children and grandchildren with unsustainable obligations.

Below is a chart from the Federal Reserve of St. Louis illustrating the US debt from 1966 through April 2017. Since the financial crisis the debt has roughly doubled.

To put this in perspective, if we were to pay off our national debt by 2525, it would cost taxpayers, excluding interest, approximately 39 billion dollars per year.

A debt of this magnitude has profound implications for our future. It will impact our national defense as well as our domestic policy. And the longer we wait, the number of options we have will continue to decrease and become more painful.

Everything you think, do and say is in the pill you took today,

In the year 2525.