There is a bear in the woods.

For some people the bear is easy to see.

Others don’t see it at all.

Some people say the bear is tame.

Others say it is vicious and dangerous.

Since no one can really be sure who is right, isn’t it smart to be as strong as the bear…if there is a bear?

If you are a political junkie, you may remember this campaign ad from the 1984 presidential race. Reagan was emphasizing that he was prepared to act aggressively against the Soviet bear. The end of the ad features a man staring down a grizzly.

While the ad is a classic piece of political advertising, I find the script relevant to bear markets as well, particularly in light of the market action we’ve seen over the past couple of months.

Our questions are similar to that of the ad:

What is a bear market?

What is the behavior of a bear?

How long do bear markets last?

What are some of the signs that a bear market is over?

What is a bear market?

A bear market is defined as a drop in equity prices of a magnitude greater than 20%. We met the definition of a bear market this year when the S&P 500 declined by roughly 33% from its February peak.

What is the behavior of a bear?

Contrary to what many assume, bear markets typically do not move in a straight line downwards. Instead they drop, plateau, rise, and then fall again.

The most famous stock market crash in U.S. history, taking place in 1929 and kicking off the Great Depression, is a helpful example. From September until November of 1929 the market fell 45%.

The market bottomed in November of 1929 and then rallied 46% through April of 1930.

From April of 1930 until June of 1932, the market reversed course and fell precipitously, resulting in an 86% loss peak to trough. An investor who purchased at the temporary bottom in 1930 would have incurred a 74.5% loss, not much better than investors who experienced the full decline.

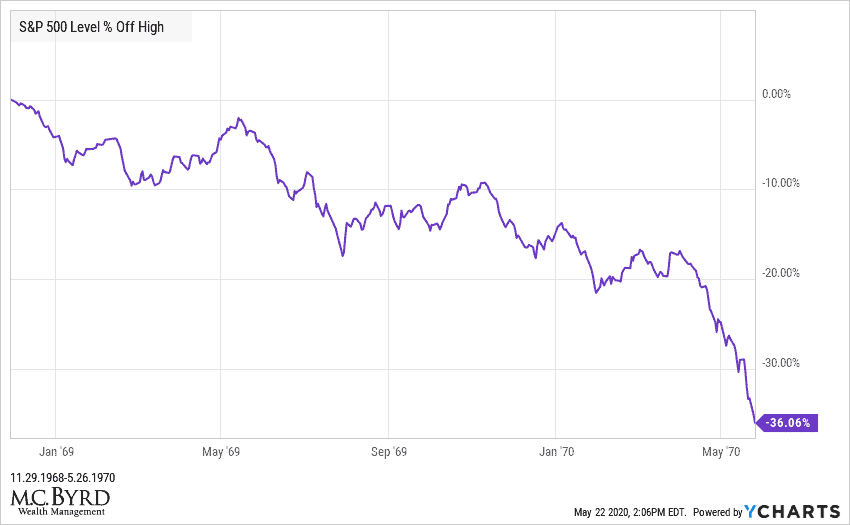

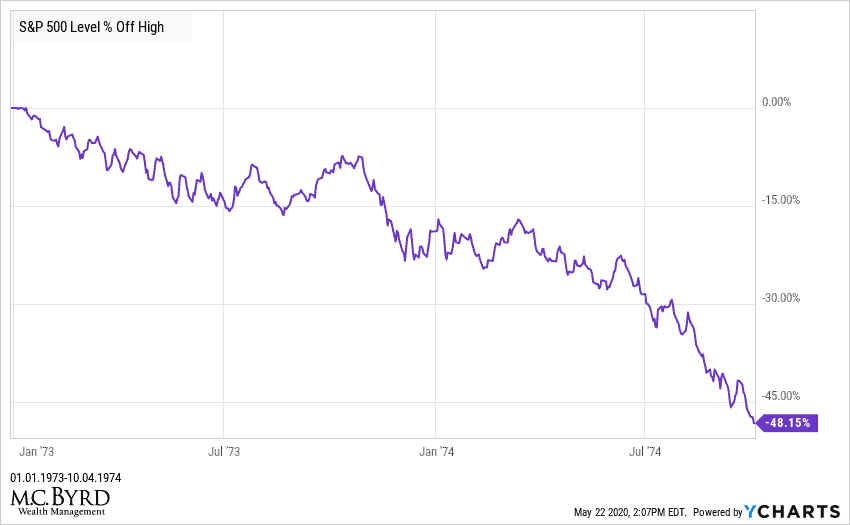

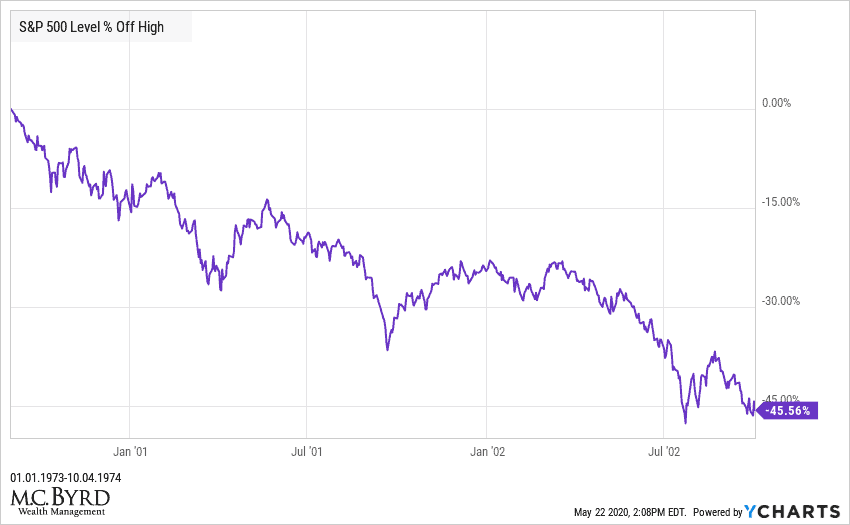

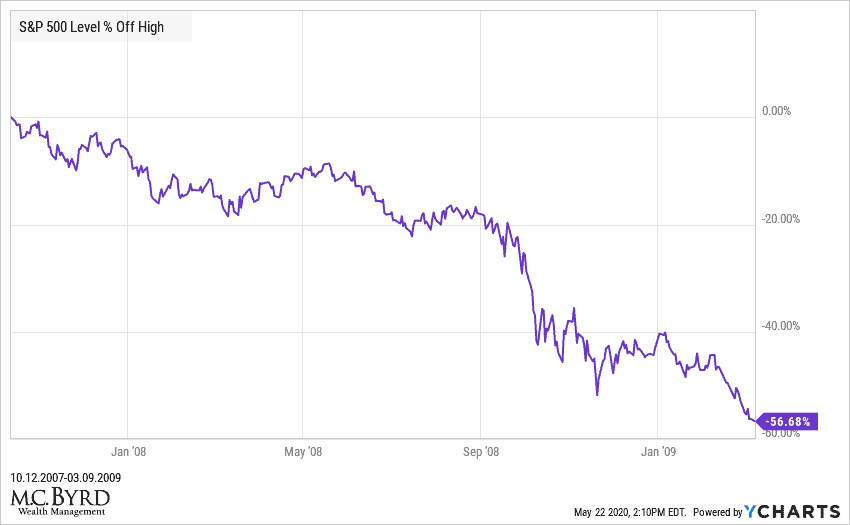

To further illustrate this point, I have charted the bear markets of 1968, 1973-74, 2000 and the financial crisis. As you can see in the charts, these bear markets were not straight drops downward but contained several rallies in the midst of a general downward trend, making lower highs and lower lows.

What are signs that the bear market is over?

Given that investors can typically expect above average returns following recessions, and the consequences of mistaking a bear market rally for a bull market can be drastic, what are some of the signs that a bear market is over?

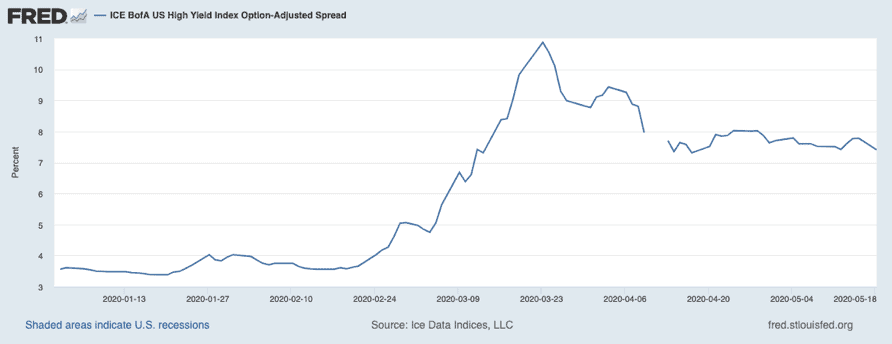

Generally, bear markets are not over until high yield bond spreads (the difference in yield between junk bonds and investment grade bonds) peak and begin to fall precipitously. The spread behavior you see below has been associated with future pain ahead in past bear markets.

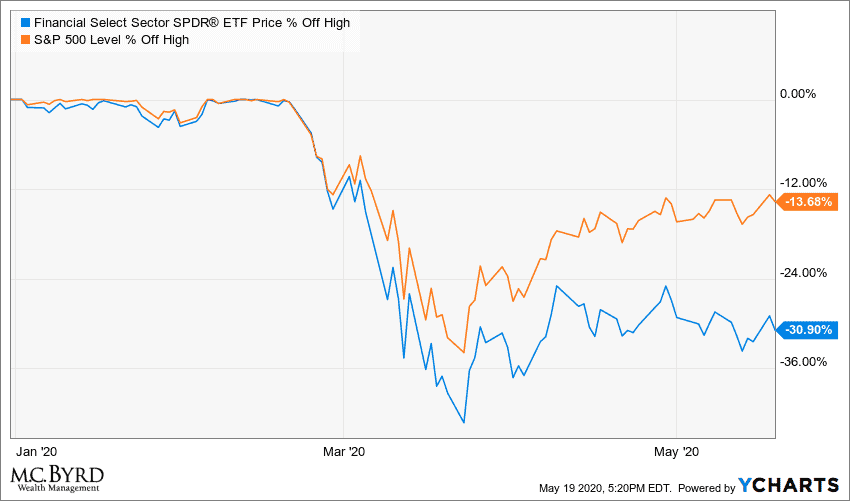

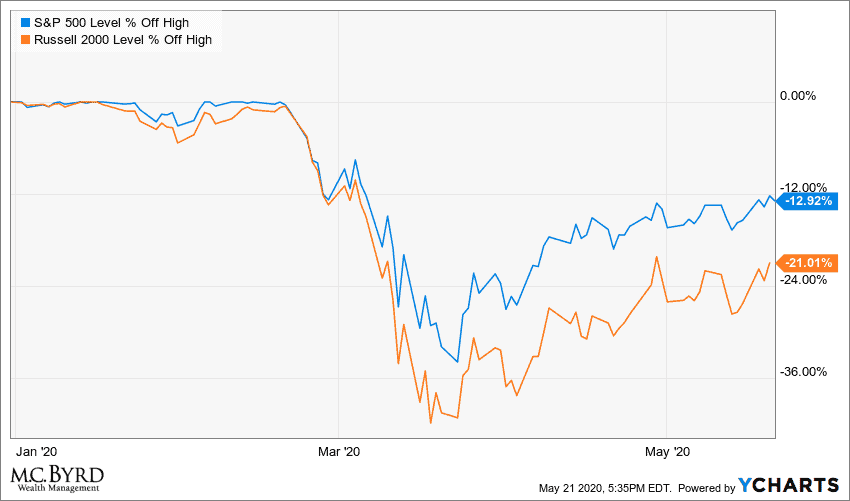

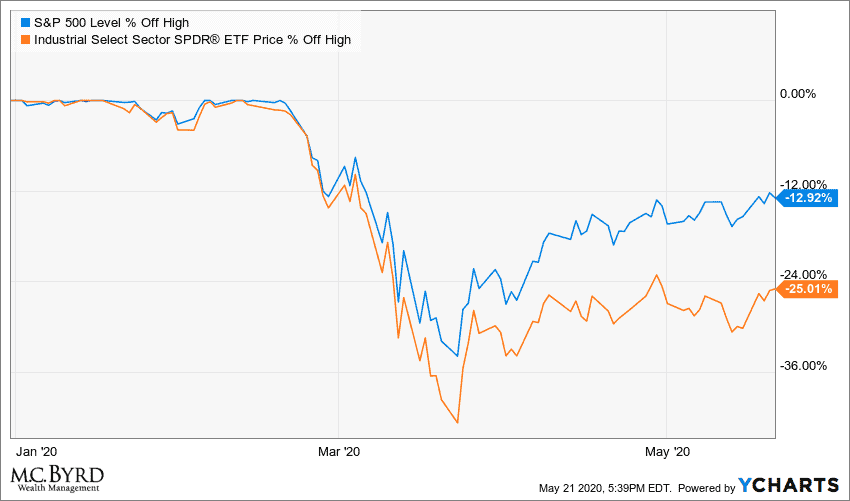

In addition to spreads peaking, bull markets tend to begin with banks, small companies and cyclical stocks, like industrial companies, outperforming the index. The opposite has occurred so far this year, as you can see in the charts below.

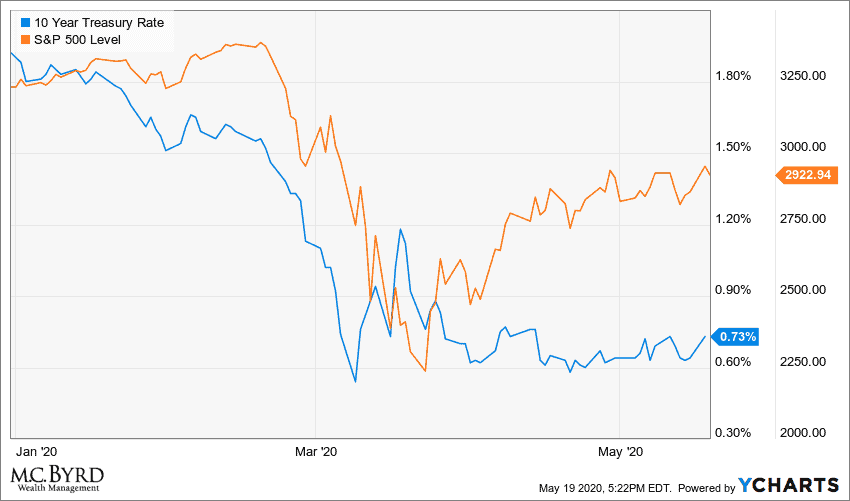

Finally, a bottom in the stock market is generally associated with rising interest rates in 10 year treasury bonds, as government debt is typically a proxy for inflation expectations. As you can see in the chart below, interest rates haven’t budged.

Years ago I had a brief encounter with a grizzly bear while hiking in Glacier National Park, a park containing the highest concentration of grizzly bears in the lower 48 states. Needless to say my experience was memorable and unpleasant. I do not wish to encounter another grizzly bear in my lifetime.

Investors should have the same frame of mind with bear markets. A wrong move can take over a decade to recover from.

Since no one can really be sure who is right, isn’t it smart be as strong as the bear…if there is a bear?