I always feel like somebody’s watchin’ me

And I have no privacy

I always feel like somebody’s watchin’ me

Is it just a dream?

“Somebody’s Watching Me” – Rockwell (1984)

The 1984 hit “Somebody’s Watching Me” is an appropriate tune for the Google COVID-19 Community Mobility Report, which used cell phone tracking software to determine changes in economic activity on a worldwide basis due to the pandemic.

The numbers are staggering for the U.S.: a 36 percent decline in workplace commuting, a 15 percent decline in retail visits and a 28 percent decline in transit station use. Each of these data points signal a continued economic drag.

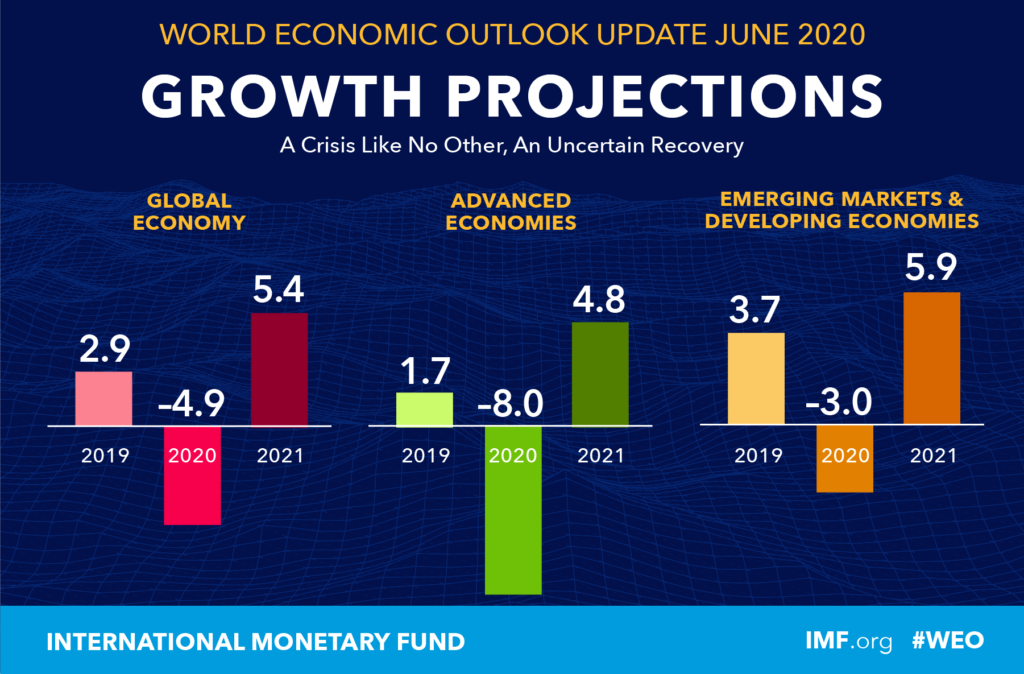

In a report issued this week, the IMF lowered their forecast for 2020 world economic growth. The United States forecast called for a decline of -8.0 percent, revised downward from previous estimates by -2.1 percent.

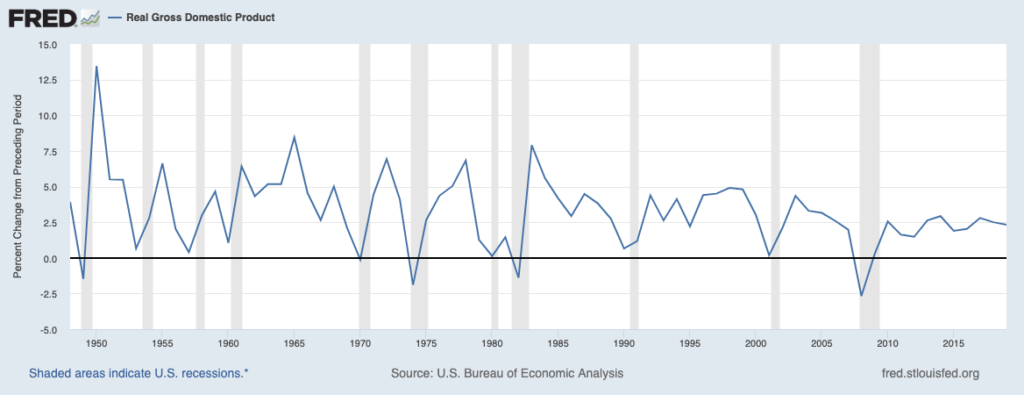

To put this in proper context, this is the largest decrease in GDP since World War II. As illustrated in the chart below, the previous postwar record was set during the Global Financial Crisis, in which we witnessed a -2.7 percent annual decline.

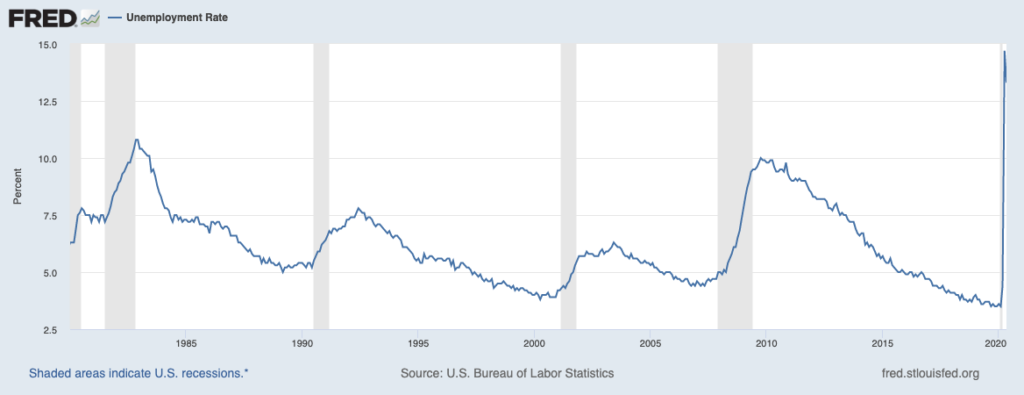

This reduction in the IMF forecast seems in line with what we are observing in the US labor market as unemployment claims stay persistently high. This week an additional 1.48 million Americans applied for unemployment. In the U.S. alone, there are nearly 20 million people currently unemployed. The unemployment data in the chart below only runs through May 1, but it illustrates the historic nature of our current labor market.

From a macroeconomic perspective the IMF is forecasting that the world economy will not recover to pre-coronavirus levels of output by the year 2021. This isn’t an abnormal forecast given historical data. The U.S. has never had a V-shaped recovery in a recession. Since the Great Depression, recessions have always involved multiple quarters. The Great Financial Crisis lasted 18 months. The 1973-75 recession lasted 16 months. Numerous recessions in the post war period hold the tie for the shortest recession length: 8 months.

The unusualness of this recession is compounded by the behavioral change induced by the pandemic. It is still out for debate whether we will witness a long-term behavioral shift as addressed here.

If mitigation efforts are successful, the effects could possibly be short-term; however, if the IMF is correct we are still looking at a post-2021 recovery. The longer social distancing measures are required, our new routine could become permanent. A permanent reordering of our economy would come at a serious economic cost.