Blog

If Recession Materializes, What Might It Mean For Stocks?

For those reading the business press, 2025 has had no shortage of headlines. Swings in the stock and bond market in April equalled some of

Can A Reduction In Government Spending Impact GDP?

With the first quarter coming to a close, we can definitively say that it has been an eventful start to the year. Headlines of tariff

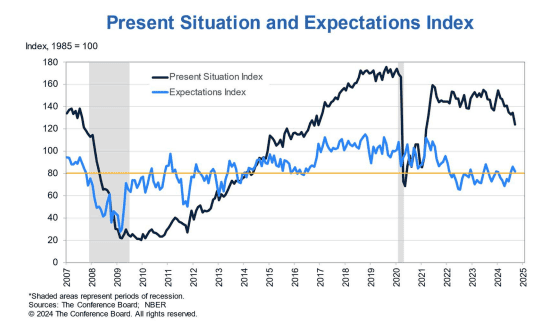

What Consumer Confidence Tells Us About Unemployment & The S&P 500

After the blistering August heat, the cool(er) winds of fall are always welcome. This year the economy appears to be cooling off at the same

The Fed Is Cutting Rates: What Does It Mean For Asset Allocation?

By now, you’ve probably heard the Federal Reserve will likely cut interest rates in September. In explaining the thinking of the board, Chairman Jerome Powell

Unemployment Data, The Sahm Rule & The Beveridge Curve

Leading indicators (e.g., the yield curve) have warned of recession since 2022. While useful, they have a variable lag time. The phenomena a leading indicator

The Two-Year Lag: What Is Economic Data Telling Us?

Earlier this year, we wrote about the 2-year lag in monetary policy and why this mattered so much for 2024. As we’re halfway through the

How We Think About Portfolio Value and Achieving Retirement Income

A common headline in the financial press reads: “Experts Say You Need X Portfolio Value To Retire.” These articles must garner significant attention, given their

Unemployment Revisions, Bankruptcies & The Fed’s Dovish Turn

Coming into 2024, the headlines touted higher-than-expected employment numbers. Contrary to expectations, the labor market appeared resilient to higher interest rates. Then came the unemployment

AI’s Impact on Market Breadth: A Sign of Caution?

It has been hard to avoid AI news in markets recently. Big tech companies have been anxious to announce the amount they’re spending to keep

Why 2022 Matters For 2024: The 2-Year Lag & Unemployment

Last week, we received a mixed bag of employment data: Finally, the job openings survey (JOLTS) dropped significantly. Job openings tend to forecast employment (or