Warren Buffett has a famous quote:

Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.

While this quote is so typical of Buffett’s folksy humor, it also points to the reason managing risk is important.

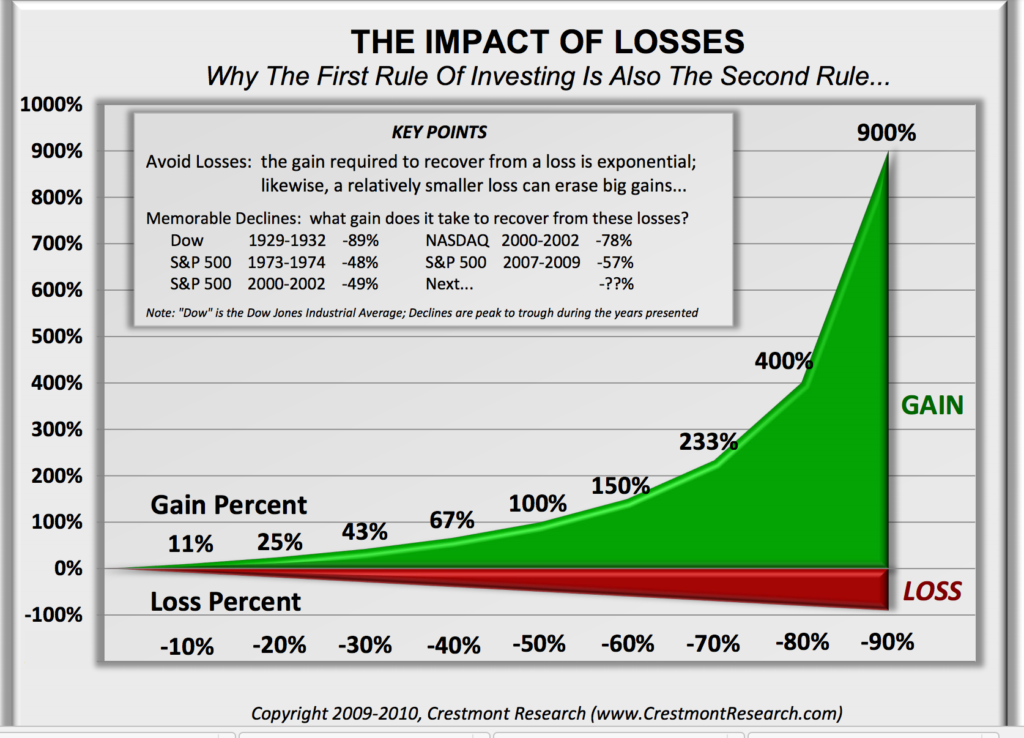

Crestmont Research did a great job of illustrating these rules using a loss calculator chart. If an investor loses 60% of their principal, following the loss a 150% gain is required to restore their initial amount.

Within the chart, Crestmont points out instances of significant drawdowns in market history.

For example, during the credit crisis, the total drawdown of the S&P 500 was 57%. Being fully invested during this type of drawdown means when the market does turn around a good portion of your gains are spent trying to get back to where you were before the loss.

For retirees this is problematic. It is especially problematic if you are over 70 and are taking required minimum distributions from your retirement account.

From age 70 to 79 your required minimum distributions will total over 43 percent of your portfolio balance. Add extended drawdowns like those illustrated in the chart and you can see how significant losses can affect your portfolio.

Folks in the investment business are prone to pull out charts that illustrate the rate of return on a $10,000 equity investment held from the 1930s until today.

The problem with that approach is that we as investors typically do not have that type of a time horizon in our investment life.

The joint life expectancy of a 65 year old couple is roughly 26 years. We do not have a ninety year time horizon to smooth out our losses.

This statistic should change our outlook on portfolio management. This is definitely true of retirees taking withdrawals from their portfolio.

According to the NBER the average business cycle lasts a little over 58 months, or about 5 years. Equity markets typically ebb and flow according to the business cycle.

The chart below illustrates the S&P 500 with the last two recessions shaded in gray.

If equity markets do ebb and flow according to the business cycle, this should have some effect on portfolio construction. Markets tend to become expensive at the end of a business cycle.

When markets are expensive, investors should consider trimming their equity exposure. When markets are cheap, they should consider rebuilding that exposure.

Remembering Rule No.1 is very important.

Footnote:

Life Expectancy calculated using Sec 1.401(a)(9)(2002)