The first quarter of 2018 was a wild ride for equity investors. January started off so promising (and unrealistic on an annual basis); however, it was followed by a February and March in which domestic and foreign market gains evaporated and returns dipped into negative territory. Only emerging markets posted a slightly positive return in spite of their late quarter losses.

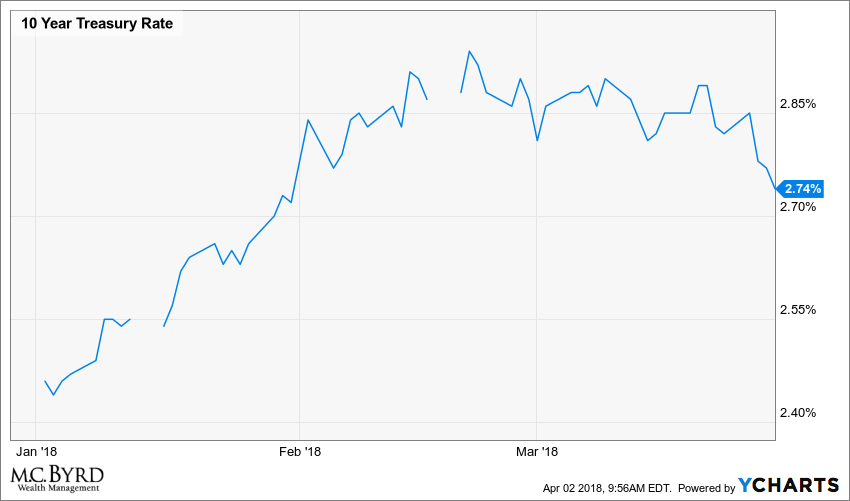

The Barclay Aggregate (AGG), representing US bond markets, was also negative for the quarter. Gold and oil both rose, helped by a plunging US dollar.

2017 was one of the least volatile years in market history. The volatility that investors experienced in the first quarter of 2018 is likely to continue. Despite recent declines, equities still stand at unprecedented valuation levels and should give prudent investors reason for caution.